All the financial experts are talking about that dreaded word ‘recession’.

I am no economist, but I’ve been around long enough to recognise that we are heading into difficult times. Between supply shortages, rising inflation, increasing interest rates, and an unstable housing market.

So how do you protect your business and come through this in good shape?

Before we dive into that it’s important to get some perspective first. Recessions will crop up eventually, a boom is always followed by a bust, spring always follows winter, they are both parts of the economic cycle.

Trades will always be needed in any part of the cycle, but in a recession there will obviously be less demand. However, the top 20% will always have enough work even when it’s quiet.

So how do you make sure you’re in the top 20%?

Here are 7 things you should know, and be working into your plan now, to be in that top 20%.

So let’s get started:

1. Downturns weed out the crop

I was talking with a seasoned tradie about this the other day. His strategy: “Don’t waste a good recession.”

Sure, it’s harder to get work when times are slow. However, everyone is in the same boat.

Your competitors who are doing a poor job, pricing too cheap, taking the quick buck and burning their reputation? These types of competitors will disappear and we are now seeing early signs of this.

Ultimately leaving more room for you.

The top tradies always have work. In any industry, the best are always in demand, regardless of what the market is doing.

Now is the perfect chance for you to get better, more efficient, become leaner and more resilient. Systemise your operations. Sharpen yourself up for the next phase.

When things bounce back, you’ll be ready to dominate, and have less competition.

2. Those who are slow to react are the worst hit

Listen up, because this one is important: You MUST be proactive with decision-making.

Watch the numbers closely. Look for the early signs so you’re not surprised.

Don’t rely on your backlog of work. Make sure you are doing all you can to keep the work flowing in.

If your efforts aren’t reflecting, and you need to cut overheads and possibly staff, as painful as it is, do it early. Not after you haemorrhage a heap of cash first.

Identify options ahead of time. Have a Plan B for all scenarios. Such as a higher overdraft facility or cash buffer in the bank.

3. Some of your customers will go broke

Have you ever been stung by a large bad debt? Most tradies have. That’s in the good times. It’s likely to happen much more in a downturn.

I often see tradies rely too much on one or two big clients. It’s risky. As a rule of thumb your biggest client ideally wouldn’t be more than 30%-40% of your business.

Assess now: If your biggest client disappeared, would you still be ok? We’ve all seen bigger companies fold and little guys get hurt.

Don’t let it happen to you: Make sure you aren’t carrying late payers, and have solid terms of trade.

4. Never stop marketing

Why should you market if you have more work than you can handle? In a downturn, things can change quickly.

Assess: Is your work coming from just one source currently? It’s not a good idea to rely on only one stream to feed you jobs through.

What if your biggest customer had their work dry up? Or went broke, and you had to deal with the receiver who didn’t want to pay you?

What if they changed owners? Or their project manager (that dishes out the work) decided he was going to use your competition instead? This can happen (and does).

Especially if word of mouth is the only way you get leads, build a larger number of sources. There are so many different and effective ways for tradies to market their services. Then even if some dry up, you will still have other streams of work.

In slow times, you can also diversify (into other types of jobs you can make money on). As well as specialising in what you are really good at. Do both! Spread your risk.

5. Cut the fat

I mean, this is something you should be doing at least once a year anyway.

I have recently taken all my clients through this. A smaller client of mine saved $17,000 from just a few tweaks. Not bad for a few hours of work.

Cash is king, and you want as much of it available as you can. Reduce overheads. Work on becoming more efficient.

Reduce debt as much as possible. In a recession, banks tighten up lending and overdrafts. Be aware of interest rate trends and your ability to pay back current debt.

6. Under-pricing leads to problems later

On some jobs, to keep the work, you might have to sharpen your pencil. Be. Very. Careful!

Don’t make the mistake of assuming if you have steady work, all will be okay. You must know at exactly what point the job is not worth doing.

In hard times, lots of tradies will do anything to get (or keep) the work. They are the ones that get into trouble first.

Know your margins. Quote too cheap and you will feel it down the line with tight cashflow and higher debt. That’s not sustainable.

There are better ways to win work and keep your margins strong. Even when things are quiet. Even when competitors are under-cutting you.

7. The strongest asset in your business is you

Have you noticed that some people always seem to get ahead no matter how big the obstacles are?

In sport, the best teams don’t always have the best players, but they consistently win anyway. The difference is superior coaching, strategy and mindset.

It is the same in business, the business is always a reflection of the owner.

So what are you doing to prepare mentally going into this new season?

Who is your mentor you can talk with on those hard days when it seems everything is falling apart? What books are you reading? What new strategies are you working on to improve?

The more you grow the better your business will perform.

One of the things that I love doing with clients is celebrating their successes or looking back with them and comparing where they are now to where they started.

The theme is always the same, the things they struggled with in the beginning they now have sorted. They slayed the dragon and recognised how to beat the next one. Every challenge is slightly different but as they start getting small wins, they accumulate and it’s not long before the battle is also won. .

You can’t control the environment, the economy, or that crazy client that is not happy no matter what you do.

But how you react will have the biggest effect on the outcome. Now is the time to get prepared and get the tools to deal with whatever happens next.

Let’s sum up.

We can’t stop the recession. But we can prepare wisely.

Carving out time for strategic thinking is key. Because when the economy changes, your approach must also change.

Remember, in a recession, there are always opportunities. But most are too busy scrambling or freaking out, to see them.

Trying to do this on your own won’t work. So build stronger connections with your network, your staff, customers, suppliers, and bank. You are going to need them.

A recession will absolutely affect your business. At times you won’t have all the answers, that’s normal. So make sure you also have a mentor (someone who understands business) to talk to regularly, and work through the issues.

If you already have a mentor – great.

If you need one, then it’s time we had a chat.

Article supplied by Daniel Fitzpatrick

www.nextleveltradie.co.nz/nextstep

www.nextleveltradie.co.nz/nextstep

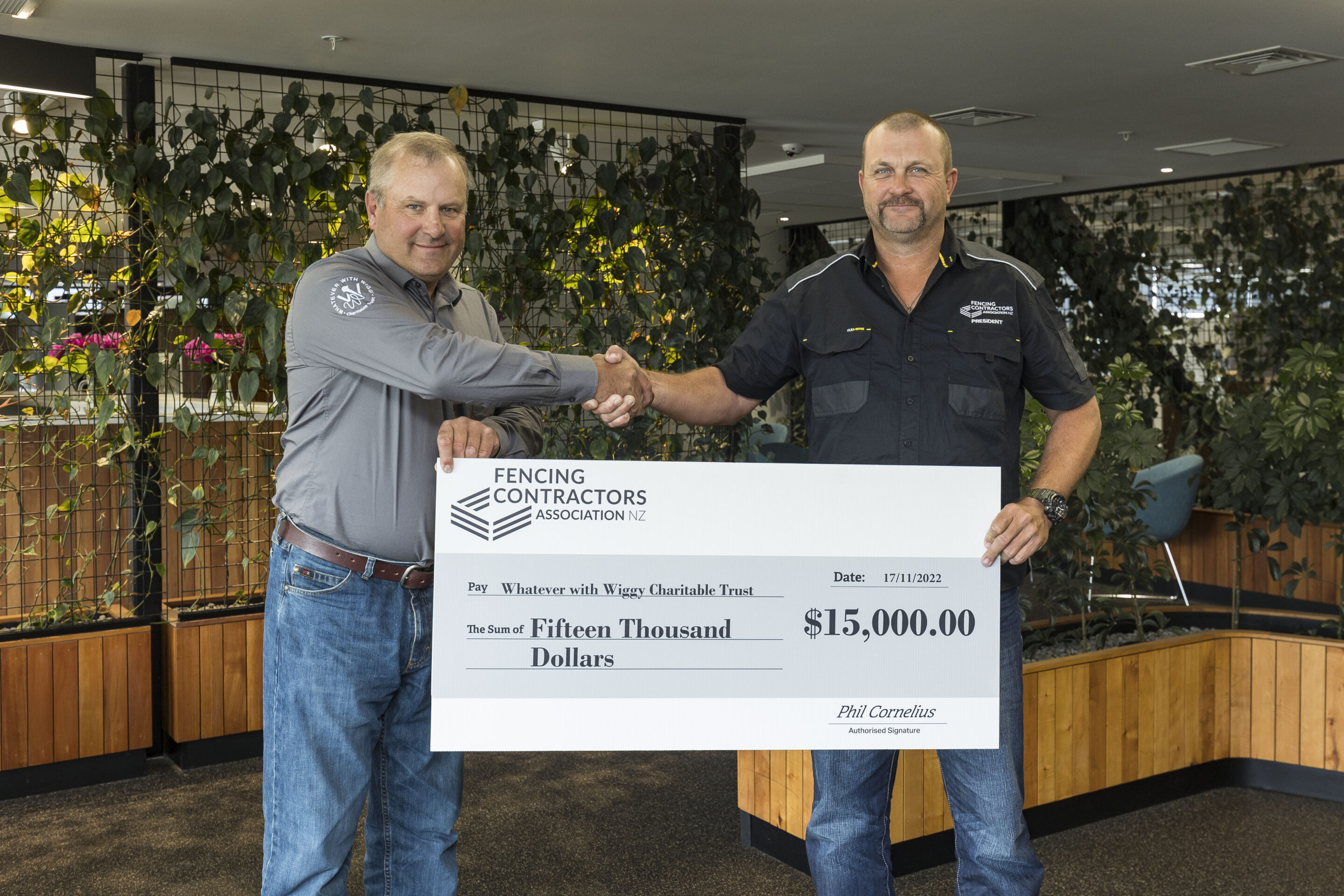

Published in the Business, Health & Safety, Environment Feature in WIRED Issue 67 / December 2022 by Fencing Contractors NZ

Read WIRED online

Follow us on Facebook

© Fencing Contractors Association NZ (FCANZ)